Indian Economy : News,Discussions & Updates

- Thread starter Butter Chicken

- Start date

-

- Tags

- indian defence forum

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Fitch revises outlook on India to stable from negative, affirms BBB- rating

Fitch Ratings has revised up its outlook on India to stable from negative while affirming the BBB- rating."The Outlook revision reflects our view that downside risks to medium-term growth have diminished due to India's rapid economic recovery and easing financial sector weaknesses, despite near-term headwinds from the global commodity price shock," Fitch said in a statement on June 10.

"We expect robust growth relative to peers to support credit metrics in line with the current rating," the rating agency added.

Fitch expects India's GDP to grow by 7.8 percent in FY23 compared with its median forecast of 3.4 percent for countries it rateds BBB.

The ratings agency had lowered the outlook to negative in June 2020 after the imposition of the draconian nationwide lockdown to contain the spread of the coronavirus. However, the stringent restrictions on movement and economic activity dragged the economy into a technical recession - or two consecutive quarters of year-on-year decline in GDP.

https://www.moneycontrol.com/news/i...-india-crosses-194-90-crore-govt-8671491.html

However, growth has since rebounded, albeit due to a favourable base effect. As per the statistics ministry's first provisional estimate, India's GDP liekly grew 8.7 percent in FY22, with the Reserve Bank of India (RBI) forecasting growth will decline to 7.2 percent in FY23. As such, Fitch's forecast is 60 basis points higher than the central bank's.

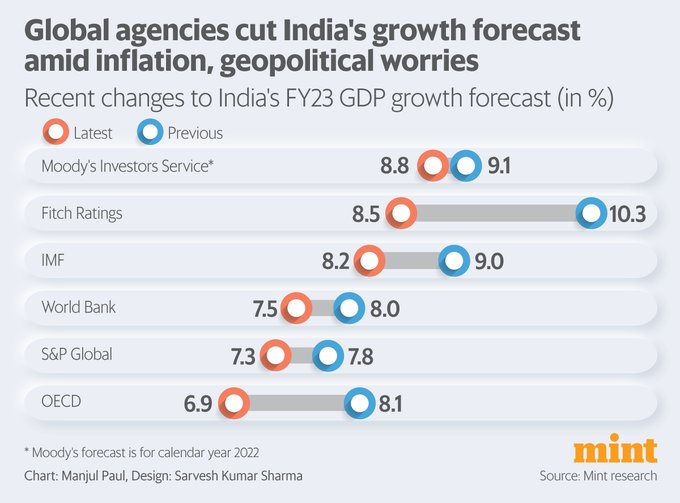

However, the agency said its latest growth forecast is 70 basis points lower than what it had forecast in March, with the impact of high global inflation "dampening some of the positive growth momentum".

In the medium-term, Fitch said India's growth outlook was "strong" relative to its peers. It expects growth of around 7 percent between FY24 and FY27.

"Nevertheless, there are challenges to this forecast, given the uneven nature of the economic recovery and implementation risks for infrastructure spending and reforms," Fitch said.

High debt

The rebound from a 6.6 percent contraction of the economy in FY21 has been key in supporting India's elevated public debt levels, which have been a key rating weakness. Fitch reiterated this on June 10, saying the country's public finances "remain a credit weakness".

"We forecast the debt-to-GDP ratio to drop to 83.0 percent in FY23 from a peak of 87.6 percent in FY21, but it remains high compared to the 56 percent peer median. Beyond FY23, however, our expectations of only a modest narrowing of the fiscal deficit and rising sovereign borrowing costs will push the debt ratio up slightly to around 84.0 percent by FY27, even under an assumption of nominal GDP growth of around 10.5 percent," Fitch said.

On the fiscal deficit front, Fitch expects the Centre to miss its FY23 target by 40 basis points and hit 6.8 percent of GDP due to the fuel excise duty cuts and increased subsidies announced in May to contain rising prices.

In the medium term, Fitch expressed doubt over the Centre's ability to lower the fiscal deficit to 4.5 percent given that "little clarity" was given in the 2022 budget on how it would be achieved.

"In our view, achieving this target could prove challenging, particularly as revenue/GDP has already returned to pre-pandemic levels," Fitch said.

With regards to monetary policy, Fitch sees the RBI raising the repo rate to 6.15 percent by FY24 to fight inflation, which it sees averaging 6.9 percent in FY23 - 20 basis points higher than what the central bank has forecast.

On Fitch's revised rating for India, Commerce Minister Piyush Goyal today said that the rating is an ''acknowledgement of Modi government's reforms agenda that has placed the economy on a strong footing, cushioning it from external variables and laying the roadmap for steady growth''.

L Catterton Asia looks to cede control in Social, Smoke House Deli operator; Piramal-Bain Fund in race

In 2017, L Catterton Asia had invested in Impresario, which backs popular f&b labels Social and Smoke House Deli.

India vs China: The advanced industry production race

A quarter century ago, it was an open question as to which nation—India or China—would vault ahead in advanced industry production. It was China that won. Between 1995 and 2018, China’s output of advanced industries grew six times faster than India’s. Notwithstanding, India has some key strengths it can build upon.To assess India’s performance, the Information Technology and Innovation Foundation (ITIF) examined data from the OECD on seven key industries: pharmaceuticals, electrical equipment, machinery and equipment, motor vehicles, other transport equipment, computers, electronics, and IT and information services. As the Indian economy has grown, many of these have gained global market share. India is a major provider of active pharmaceutical ingredients and the US is the largest market for Indian IT services suppliers such as TCS, Infosys, Wipro etc, which collectively enjoyed some $50 billion in sales in 2020.

There is another way to examine India’s advanced industry strengths—looking at their share of India’s economy compared to the global economy; what regional economists term a location quotient (LQ). If India had the same share of advanced industries as the global economy, its LQ would be 1. In 1995, India’s LQ for advanced industries 0.66, meaning that its advanced industry production as a share of its economy was a third lesser than the rest of world. But by 2018, its LQ had increased to 1.14. In fact, the Indian economy is now more specialised in advanced industry than is US’s (LQ 0.94), but less than China’s (1.3) and Germany’s (1.6). India had 44% more pharmaceutical production as a share of its economy than the global average in 2018, and 89% more IT and other information services. Performance and prospects are much better than they were a decade ago. From 1995-2014, advanced industry production in China grew more than nine times faster than in India.

However, from 2014-2018, Chinese output grew just 50% faster than its Indian counterpart. But when looking at percentage growth, it was a completely different picture: output in all seven industries grew faster in India than China, with overall advanced industry output growing 43% faster in India. Given the efforts by the Trump administration to limit China’s predatory economic and technology practices, with the current slowdown in the China economy, it is likely that these trends have continued and perhaps even risen to this day.

So what can India do to take advantage of this favourable trend? First, India’s R&D tax credit should be increased. India ranks 26th of 34 major countries in R&D tax generosity. If it wants to exceed China’s credit generosity and move to the 7th rank, it would need to triple its R&D credit rate. For this, it could start with incentivising R&D in its $27 billion PLI programme. Second, India will need to strengthen its intellectual property system, including patents, and build entrepreneurial and institutional capacity to leverage it. Third, the world is moving away from the post-Cold War utopian model of global free trade. China helped destroy that with its aggressive innovation mercantilist actions and its threats to the global order. As such, there is likely to be continued decoupling from China by democratic nations. India is well positioned to take advantage of that trend, and build its advanced economy in part on production moving out of China. It has already begun to engage with rest of the world on these lines. Another key step is to engage deeply with the Indo-Pacific Economic Framework proposed by the Biden administration in a mutually beneficial manner. The bottom line is to make it easier for MNCs and domestic enterprises to do business in India. This will require unrelenting focus on enhancing India’s competitiveness through convergence between policies both horizontally and vertically and improving implementation.

India has made significant progress on advanced industries, particularly in the last decade. It has the potential to make even more progress in this coming decade, but only if it takes the needed steps to succeed.

(Atkinson is president, Information Technology and Innovation Foundation, Washington DC, USA. Mehta is secretary-general, CUTS International, India)

$38k fine for concealing $5.7 billion investment, welcome to India. Guess what even if facebook sets fire to India nothing will happen.

finance.yahoo.com

finance.yahoo.com

India fines Reliance for not promptly disclosing 2020 Facebook deal

MUMBAI (Reuters) -India's market regulator on Monday fined Reliance Industries and two of its compliance officers for violating fair disclosure norms during Facebook's $5.7 billion investment in its digital unit in 2020. In April 2020, Meta's Facebook invested $5.7 billion in Reliance's Jio...

India jumps 6 places to 37th rank on IMD’s World Competitiveness Index; Denmark tops the chart

India has witnessed the sharpest rise among the Asian economies, with a six-position jump from 43rd to 37th rank on the annual World Competitiveness Index compiled by the Institute for Management Development, largely due to gains in economic performance.Denmark has moved to the top of the 63-nation list from the third position last year, while Switzerland slipped from the top ranking to the second position and Singapore regained the third spot from fifth, a global study showed on Wednesday.

Others in the top 10 include Sweden at the fourth position, followed by Hong Kong SAR (5th), the Netherlands (6th), Taiwan (7th), Finland (8th), Norway (9th), and the USA (10th).

Meanwhile, the top-performing Asian economies are Singapore (3rd), Hong Kong (5th), Taiwan (7th), China (17th), and Australia (19th).

After a stable but stagnant five years, 2022 witnessed significant improvement in the competitiveness of the Indian economy, IMD said, adding that this is largely due to gains in economic performance (from 37th to 28th).

The domestic economy has experienced a stratospheric rise from 30th to 9th position in a year, Institute for Management Development (IMD) noted.

The labor market, a key sub-factor in the business efficiency parameter, moved up from 15th to 6th, while management practices and business attitudes and values also made major leaps.

“With Prime Minister Narendra Modi has made major improvements in the context of retrospective taxes in 2021, India appears to have restored the trust of the business community. Its re-regulation of several sectors, including drones, space, and geo-spatial mapping, also likely played a role in the country’s stellar performance in the 2022 WCR,” economists at IMD World Competitiveness Centre said.

India is also a driving force in the global movement to fight climate change and Modi’s pledge of net-zero by 2070 at the COP26 summit in November 2021, sits in harmony with its strength in environment-related technologies in the ranking.

The challenges that India has to face include managing trade disruptions and energy security, maintaining high GDP growth post the pandemic, skill development, and employment generation, asset monetization, and resource mobilization for infrastructure development.

The top five attractive factors of India’s economy for business are – a skilled workforce, cost competitiveness, dynamism of the economy, high educational level, and open and positive attitudes.

The IMD World Competitiveness Ranking (WCR) found that inflationary pressures are affecting the competitiveness of national economies along with COVID, and the invasion of Ukraine by Russia.

The three most important trends found to be impacting businesses in 2022 are inflationary pressures (50 percent), geopolitical conflicts (49 percent), and supply chain bottlenecks (48 percent) with COVID being the fourth (43 percent).

“Inflationary pressure is affecting most economies,” said Christos Cabolis, Chief Economist at the WCC.

“Other global challenges affecting the competitiveness of countries include variants of COVID-19 concerning the number of infected people around the world; differing national policies to address COVID (the ‘zero-tolerance COVID’ policy versus the ‘moving on from COVID’ policy); and the invasion of Ukraine by Russia.”

Meanwhile, China slipped one spot this year, reversing its strong upward trend of recent years, signaling a poor economic recovery exacerbated by its zero-COVID strategy.

China improved its business efficiency, more specifically productivity, and increased its real GDP growth rate compared to the last year.

“Going forward, China needs to restructure the economy from manufacturing to high-value services and from investment to consumption.

It also needs to build a unified national market to enhance long-term economic prosperity, and it will only achieve its socio-economic development goals by using a macroeconomic policy mix,” explain the economists at IMD’s WCC.

IMD business school in Switzerland and Singapore released the 2022 World Competitiveness Ranking.

Its think-tank, IMD World Competitiveness Center, ranks 63 economies and assesses the extent to which a country promotes the prosperity of its people by measuring economic well-being via hard data and survey responses from executives.

India jumps 6 places to 37th rank on IMD’s World Competitiveness Index; Denmark tops the chart

After staying stagnant for five years, India's economic competitiveness improved significantly in 2022, jumping six places on the IMD's World Competitiveness Index. Meanwhile, Singapore, Hong Kong, Taiwan, and China proved to be the top-performing Asian economies.

India exits $3-trillion m-cap club; falls to sixth in global league

India exits $3-trillion m-cap club; falls to sixth in global league

As the market has seen its value slip to $2.99 trillion, the lowest in nearly 13 months, the Indian market is no longer part of the coveted $3-trillion market cap club.

India to pump $30bn into tech sector and chip supply chain

TAIPEI -- India will spend $30 billion to overhaul its tech industry and build up a chip supply chain to ensure it is not "held hostage" to foreign providers, the country's top diplomat to Taiwan told Nikkei Asia in an interview.The investment initiative is aimed at increasing local production of semiconductors, displays, advanced chemicals, networking and telecom equipment as well as batteries and electronics, said Gourangalal Das, director-general of the India-Taipei Association, the South Asian country's de-facto embassy in Taipei.

"There is a rise in demand for semiconductors," Das said, adding that India's chip demand is growing at nearly double the global rate each year. "By 2030, India semiconductor demand will reach $110 billion. So by that time, it will be over 10% of global demand."

"We need some assurance that our demand for semiconductors is not held hostage to the vagaries of supply chains -- something that we saw during the pandemic," the diplomat said.

Unlike the U.S. and European Union, which aim to bring some of the most cutting-edge chip production to their shores, Das said his country is looking to bring in more "mature" chips. These include chips made with the relatively less advanced 65-nanometer to 28-nanometer production technologies and are widely used in connectivity chips, display drivers, controller chips for electronics products and electric vehicles.

In addition to a massive domestic market, India has an ample pool of engineers, which will help the country attract foreign investors and overhaul the local electronics industry, Das said.

He added that India is open to collaborations with Taiwanese tech players who have semiconductor, display and electronics manufacturing expertise. One early entrant is iPhone assembler Foxconn, which has partnered with Indian natural resources conglomerate Vedanta to build a semiconductor plant in the country.

Apart from chips, India sees displays as critical components, as it hopes to become more self-sufficient in the production of TVs, tablets, smartphones and automobiles. "The demand is going to grow and you cannot be in a perpetual state of import dependency," Das said.

He added that India was not only looking at liquid crystal diode (LCD) display technology, which is widely used in TVs, but also at the higher-end

organic light-emitting diode (OLED) displays that have become the mainstream in premium and foldable smartphones.

One area India is not lacking, Das said, is in tech talent. The country has a huge pool of "young talent" and is still enjoying a "demographic dividend" that could last till 2050 even as many East Asian countries are already facing population declines, he said.

India is looking to meet not only its own needs for tech talent but also to fill the skills shortages worldwide, Das said. Chip companies in

particular are struggling to find enough qualified engineers to keep up with their global expansion plans.

India has set a target of producing 85,000 highly qualified engineers in 10 years.

Das said the key aim of India's $30 billion initiative is to build a complete supply chain ecosystem. Around $10 billion of that sum will go toward two chip facilities and two display plants. About $7 billion is planned to be given to the electronics industry, including those manufacturing giants like Foxconn and fellow iPhone assembler Pegatron. The remaining $13 billion will be reserved for "affiliated services like telecom, networking, solar photovoltaic, advanced chemistry and battery cells," he said.

The government introduced "Digital India," the country's flagship economic transformation program to upgrade its industries, in 2015. Those efforts have been further accelerated by the pandemic.

India has developed several tech hubs in the south over the years. Foxconn, BMW and Samsung, among others, have already set up plants there, while major global chip developers such as Intel, Qualcomm and Nvidia operate research and development centers locally. The western India state of Gujarat is home to key manufacturing plants of leading chemical producers such as Tata Chemicals, Gujarat Fluorochemicals and Atul.

Although India does not yet have a chip supply chain like the U.S., EU or Japan, the country has a number of key advantages, Das said. In addition to its large number of engineers, these include natural resources for metals, gas and chemicals. For instance, India is the world's leading producer of sulfuric acid and ammonia, which, after being purified, can be used in chip manufacturing processes.

"Even though India has not gone into the semiconductor [industry] in a big way, it has all the associated industrial capabilities, which can be tweaked a little bit or upgraded a little bit to meet the demands," Das said. "It's not like India's learning curve is going to be very steep... But we will be patient and we will be quite persistent."

India to pump $30bn into tech sector and chip supply chain

South Asia nation open to working with Taiwanese players to realize ambitions

India could very well be in stagflation situation before end of next fiscal: Mythili Bhusnurmath

“The 8.7% growth must be taken with a pinch of salt. It comes on the back of a contraction in previous fiscal going forward growth as we are nowhere near our potential. It will be perhaps stagnant to that extent. Stagflation is the combination of stagnant growth and high inflation. We could very...

Asia’s Richest Man, Gautam Adani, Raises $775 Million To Build India’s Largest Copper Refinery

Adani Enterprises is pushing ahead with plans to build India’s largest copper refinery as the world’s second most populous nation seeks to reduce its reliance on metal imports.

www.forbes.com

www.forbes.com

India misses fifth-largest economy in the world tag by $13 billion

India misses fifth-largest economy in the world tag by $13 billion

Experts say it is just a matter of a year before India overtakes the UK

India best performing among major economies in the world: Report - Times of India

India Business News: India, through its effective dynamic policy environment, is the only economy among the top ten leading economies which has shown consistent improvemen

India goes for global trade payments in rupees: What it means & challenges ahead

The Reserve Bank of India (RBI) has announced that it is putting into place a mechanism for international trade settlements in rupees. The order takes immediate effect and the mechanism is designed to "promote growth of global trade with emphasis on exports," the RBI said."In order to promote growth of global trade with emphasis on exports from India and to support the increasing interest of the global trading community in INR, it has been decided to put in place an additional arrangement for invoicing, payment, and settlement of exports/imports in INR," the RBI said in a statement on Monday.

The RBI's order comes at a time when the rupee has crashed to record low levels against the US dollar in recent weeks.

Last week, the State Bank of India (SBI) proposed that RBI should make a "conscious effort to internationalise the rupee". The SBI in its "Research Ecowrap" stated, "The Russia-Ukraine war and the disruptions to payments caused by it, is a good opportunity to insist on export settlement in rupees, beginning with some of the smaller export partners."

INTERNATIONAL TRADE SETTLEMENTS IN RUPEE: WHAT DOES IT MEAN?

The RBI has detailed the broad framework for cross-border trade transactions in rupees under the Foreign Exchange Management Act, 1999 (FEMA):1. All exports and imports under this arrangement may be denominated and invoiced in rupees.

2. Exchange rates between the currencies of the two trading partner countries may be market determined.

3. The settlement of trade transactions under this arrangement must take place in rupees.

WHAT IT MEANS FOR IMPORTS AND EXPORTS

Indian importers undertaking imports through this mechanism need to make payment in rupees which must be credited into a Special Vostro account of the correspondent bank of the partner country, against the invoices for the supply of goods or services from the overseas seller or supplier.Similarly, Indian exporters, undertaking exports of goods and services through this mechanism, must be paid the export proceeds in rupees from the balance in a designated Special Vostro account of the correspondent bank of the partner country.

RUPEE AS INTERNATIONAL CURRENCY

A currency is generally termed 'international' if it is widely accepted across the world as a medium of exchange for trade.The US dollar is the most widely accepted currency for international trade, followed by the European euro.

Earlier in the 1960s, the rupee was accepted in gulf countries such as Qatar, the UAE, Kuwait, and Oman. India also had payment agreements with eastern Europe and the rupee was used as a unit of account under these payment agreements. However, in the mid-1960s, these arrangements were terminated.

CHALLENGES AHEAD

The rupee can be transformed into an international currency by making it a stable currency to enable international trade or by keeping it as an asset.To simplify, we can say that the rupee needs to become a currency in which assets are held.

The rupee becoming an international currency would likely to reduce India's trade deficit. The rupee will be strengthened in the global market. Other countries may start adopting the rupee as their trade currency.

However, there are challenges in internationalization of the rupee as a currency of trade.

"Internationalising the rupee is easier said than done. Increasing external trade denominated in rupee terms instead of the more popular currency -- the US dollar -- will be quite difficult," Sandeep Bagla, CEO of Trust Mutual Funds, told IndiaToday.In.

"The rupee will have to be made fully convertible. Unless markets are deep with large financial institutions other than the RBI, large flows could lead to volatility in the value of the rupee, which could make monetary policy setting difficult for the central bank," Bagla said.

In the short run, it would be difficult.

India needs to start exporting more to other countries. Also, India needs to become a manufacturer as that would significantly help the rupee become a currency of trade.

For example, on March 23 this year, Russian President Vladimir Putin announced that European countries would have to pay in Russian currency rubles instead of the US dollar or the euro, for all natural gas imports. Putin could make the demand because Russia supplies 40 per cent of the European Union's natural gas requirements.

If the rupee is internationalised, then India will truly become self-reliant.

India goes for global trade payments in rupees: What it means & challenges ahead

The Reserve Bank of India's (RBI) order comes at a time when the rupee has crashed to record low levels against the US dollar in recent weeks.

Worst of inflation may be behind us, RBI staff say in July 2022 Bulletin

According to the July Bulletin article, the current level of reserves were equivalent to 9.5 months of imports projected for 2022-23