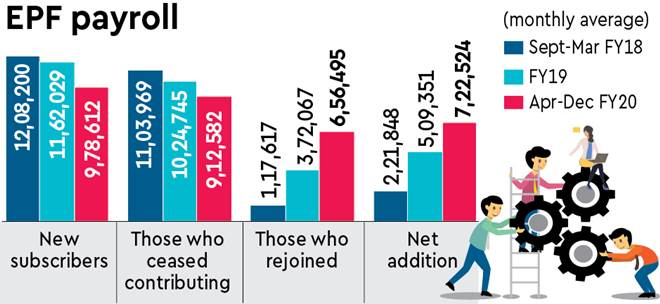

Jobs are back? EPF base expands faster in FY20

The jobs market may be brightening up, finally. Or, at least, tens of thousands of jobs lost during the period after note ban are being retrieved. As per latest EPFO data, the subscriber base of the retirement funds body saw average net addition of 7.22 lakh per month in April-December this fiscal, compared with 2.21 lakh in the last seven months of 2017-18 — the year which saw the unemployment rate spike, controversially, to 6% — a 45-year high. The monthly net addition to EPFO subscriber base was 5.1 lakh in FY19.

Of course, all increases in EPFO payroll numbers aren’t attributable to ‘new jobs’; the accelerated expansion of the subscription base is partly driven by policy support to formalisation of the economy, including Pradhan Mantri Rojgar Protsahan Yojona (PMRPY), the window for which closed on March 31, 2019. But the fact that people in the 22-25 years age bracket followed by 18-21 years have the highest share (27.45% and 26.3%, respectively) of net EPF subscribers added in the first nine months of FY20 is proof that jobs are now being created at a faster pace than in FY18. The EPFO has started releasing the data for subscription since April 2018. Analysts caution that the data may not be robust enough to draw immediate conclusions from.

One curious aspect of the EPFO payroll data is the high frequency of subscribers stopping contributions. For instance, as many as 9.13 lakh people ceased subscriptions in April-December this fiscal, which was almost as many as the new subscribers joined during the same period (9.79 lakh).

Of course, 6.56 lakh workers who stopped contributing to the EPF rejoined in the period, resulting in net additions of 7.2 lakh.

Such high incidence of people quitting EPFO subscription cannot be explained by regular retirement. Demonetisation may be to blame, to an extent. Also, a section of establishments is averse to keeping the employees for longer periods to escape legal obligations like payment of gratuity. It is also a practice, a person familiar with the government’s EPF data methodology said, among some businesses to float new companies to rein in their manpower costs.

A decline in the pace of new subscribers from an average of over 12 lakh a month in September-March FY18 to 11.62 lakh a month in FY19 and to 9.79 lakh a month in April-December FY20 signals the saturation of the current formalisation drive. Since the informal sector in the country is huge, innovative policies may be needed to accelerate the formalisation process.

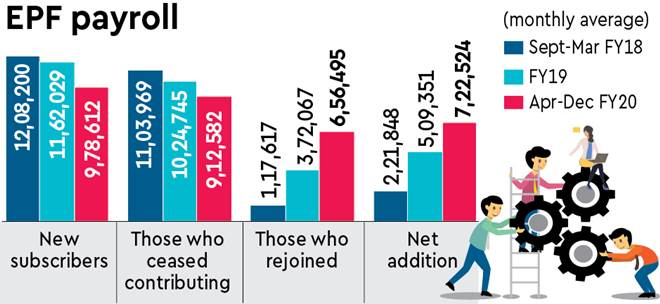

Jobs are back? EPF base expands faster in FY20

The jobs market may be brightening up, finally. Or, at least, tens of thousands of jobs lost during the period after note ban are being retrieved. As per latest EPFO data, the subscriber base of the retirement funds body saw average net addition of 7.22 lakh per month in April-December this fiscal, compared with 2.21 lakh in the last seven months of 2017-18 — the year which saw the unemployment rate spike, controversially, to 6% — a 45-year high. The monthly net addition to EPFO subscriber base was 5.1 lakh in FY19.

Of course, all increases in EPFO payroll numbers aren’t attributable to ‘new jobs’; the accelerated expansion of the subscription base is partly driven by policy support to formalisation of the economy, including Pradhan Mantri Rojgar Protsahan Yojona (PMRPY), the window for which closed on March 31, 2019. But the fact that people in the 22-25 years age bracket followed by 18-21 years have the highest share (27.45% and 26.3%, respectively) of net EPF subscribers added in the first nine months of FY20 is proof that jobs are now being created at a faster pace than in FY18. The EPFO has started releasing the data for subscription since April 2018. Analysts caution that the data may not be robust enough to draw immediate conclusions from.

One curious aspect of the EPFO payroll data is the high frequency of subscribers stopping contributions. For instance, as many as 9.13 lakh people ceased subscriptions in April-December this fiscal, which was almost as many as the new subscribers joined during the same period (9.79 lakh).

Of course, 6.56 lakh workers who stopped contributing to the EPF rejoined in the period, resulting in net additions of 7.2 lakh.

Such high incidence of people quitting EPFO subscription cannot be explained by regular retirement. Demonetisation may be to blame, to an extent. Also, a section of establishments is averse to keeping the employees for longer periods to escape legal obligations like payment of gratuity. It is also a practice, a person familiar with the government’s EPF data methodology said, among some businesses to float new companies to rein in their manpower costs.

A decline in the pace of new subscribers from an average of over 12 lakh a month in September-March FY18 to 11.62 lakh a month in FY19 and to 9.79 lakh a month in April-December FY20 signals the saturation of the current formalisation drive. Since the informal sector in the country is huge, innovative policies may be needed to accelerate the formalisation process.

Jobs are back? EPF base expands faster in FY20