India set to benefit as wind power gains speed

India’s economy is the world’s sixth-largest by nominal GDP and the third-largest by Purchasing Power Parity (PPP). It is the world’s fastest growing major economy, as well. India is the third largest energy consumer in the world and is the backbone of the economy. Access to cheap energy is essential to India’s sustained accelerated growth. As per International Energy Agency (IEA), India’s aggregate energy consumption will more than double by 2040. This growing demand for energy has been traditionally dependent on imports of conventional energy like coal, oil and natural gas which poses a threat to India’s energy security. Strategically, it is important that a country is energy independent or it meets the requirements of energy security which means ‘the uninterrupted availability of energy sources at an affordable price’.

India has a high potential for generation of renewable energy from various sources—wind, solar, biomass, small hydro and the cogeneration of bagasse. The total potential for renewable power generation in the country as on March 31, 2017, is estimated to be at 1001 GW which includes a solar potential of 650 GW, 302 GW of wind power potential at 100 m hub height, small hydro potential of 21 GW, biomass power of 18 GW, 7 GW from bagasse based cogeneration in sugar mills and 2.5 GW from waste to energy.

Renewable energy offers significant potential to contribute towards the growth and development of India’s power sector without impacting the fuel reserves or greenhouse gas emissions. It is essential that India deploys all available energy resources including renewables to ensure energy security. According to the International Renewable Energy Agency (IRENA), wind power has emerged as one of the fastest-growing clean energy sources in the world.

Considered much cheaper than solar, wind energy is globally emerging as a favourite option, especially when energy is a major expense. It is now being deployed and is operational in many countries. This change is purely driven by improved economics of wind energy and a shift from dependence on fiscal benefits. National concerns and leadership thrust on energy security, emissions reduction and cost-effective generation also makes wind energy the preferred choice.

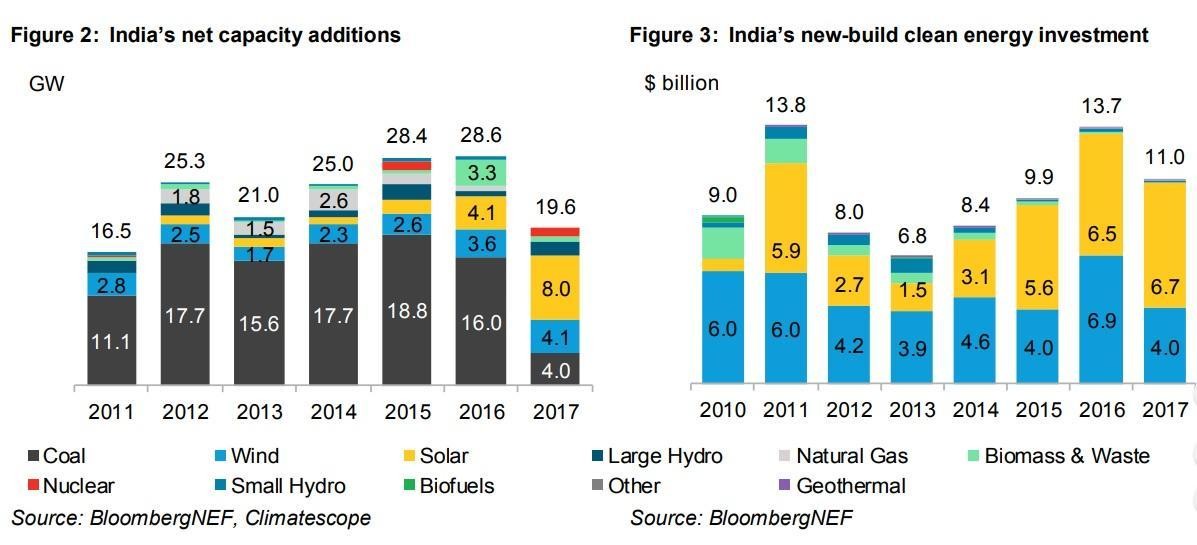

Wind power development, which started in India in the 1990s, has significantly increased in the last few years. India plans to add 60 GW of wind power installed capacity by the year 2022. Although a relative newcomer to the wind industry as compared to Denmark or the US, domestic policy support for wind power has enabled India to become the fourth largest in the world with an installed capacity of over 34 GW as of June 2018. The total installed capacity of renewable power, which was 43 GW as on March 2016, had gone up to 57 GW as on March 2017. Of this, wind power alone accounted for 56% of renewable power capacity.

According to Global Data’s Wind Power Market Update 2018, the size of the global wind power market increased from $21.4 billion in 2006 to $94.5 billion in 2017, at a CAGR of 14.4%. The global cumulative installed capacity for wind power grew from 74.6 GW in 2006 to 547.3 GW in 2017, at a CAGR of 19.9%. There was a total addition of 52.3 GW in 2017. During 2018–2025, the wind power market size is expected to increase from $94.9 billion to $98.9 billion.

The boost is primarily driven by robust government policies, and an increase in capacity, led by India, China, the US, Germany and other emerging countries. The need for cleaner, reliable, and affordable power is further stimulating this growth. Interestingly, wind power is more popular than solar in the US. Out of all the renewable energy produced in the US in 2017, 21% came from wind, while just 7% came from solar power. Utilities and large-scale operations prefer heavily utilised wind energy while homeowners prefer solar energy. India is no exception. The nation produced 102 billion units of power from renewable sources, or close to 8% of the total, in the year ended March 2018. With wind energy leading the growth, it contributed 52.7 billion units, solar contributed about 25.9 billion, 11.8 billion from bagasse (sugarcane) and 7.7 billion units from small hydro power.

With the right steps, India’s wind industry is poised to meet the government’s revised target of 67 GW ahead of 2022. Moreover, wind is riding strong on the competitive bidding regime and an increased demand for green energy that is reliable, affordable and a mainstream source of energy. The wind Industry is regaining momentum, considering there is a clear visibility of 10-12 GW with a plan of further bids by the ministry of new and renewable energy (MNRE). Some Indian states have also come up with novel schemes by identifying areas where agriculture is not very intensive and remunerative. Such initiatives do not involve the process of land acquisition, while making use of the land for a fixed annual payment carried through a partnership between the government and farmers. Piloting technologies such as the wind-solar hybrid, where both windmills and solar panels are put up on the same piece of land, are also paying off well.

India’s renewable energy sector has attracted investments of over $42 billion over the past four years and green energy projects have created over 10 million man-days of employment per annum over this period. As per the power ministry’s study to meet energy requirements for the year 2026-27, India will need to build 275 GW of renewable energy capacity by the end of 2026-27.

The nation’s strategy to decarbonise its electricity supply industry has been augmented by advanced technologies, cost reduction, and a growing interest from global renewable players, utilities and investors. It offers a sustainable solution to the country’s growing energy requirement and climate change issues, whilst also reducing its excessive reliance on imported and expensive fossil fuels, provides an opportunity to create jobs and boosts the government’s ‘

Make in India’ program with manufacturing potential in the entire energy efficiency value chain.

Certainly, at the current rate, India’s wind industry is on course to add 30 GW of new capacity in the next three years, taking the cumulative total capacity to over 64 GW. This brings an edge of scale at the project level and cost optimisation. With an improvement in technology, the next-generation turbines can deliver around 35-40% plant load factor (PLF) in high wind states, about twice the PLF compared to solar.

Technological advancement in the wind sector is also making it possible to harness wind at sites which were earlier unviable. Going by these trends, India seems to be on track to double its wind capacity. While Karnataka and Tamil Nadu currently lead the way in renewables, other states of India are also poised to harness wind energy.

Further, conducive policies such as exemption of interstate transmission charges and losses on solar and wind power projects up to March 31, 2022, are giving impetus to expand the reach of renewables. As available supply and market demand continues to grow in an increasingly healthy market, wind energy is set to become more important across the globe. This would place India amongst the leading wind energy producers in the world. The future looks green and bright for wind. This trend will greatly enhance India’s energy security.

India set to benefit as wind power gains speed