https://www.rnaval.co.in/board-of-directorsRNEL and L&T are facing the same problems. L&T has a bigger order because they are an older company. But both RNEL and L&T have very similar expertise. And their managements are also equally good. You many not like Anil, but the RNEL management is composed of accomplished people.

https://www.rnaval.co.in/board-of-directors

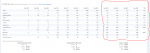

You say that ignoring all the numbers you have posted yourself. 3500cr PAT vs 935cr loss, how are they even in the same league?

let me ask what happened post March 2015 that RNEL has just collapsed?

As for the OPV, the actual construction delay is very limited. The two ships made by RNEL were the first warships made by a private shipyard, which is a pretty big deal. The new designs were unveiled in 2014, and are expected to be delivered early next year. So they have kept to their new schedule, more or less. Compared to that, not one DPSU has ever delivered a warship on time, or without cost overruns. Whereas the RNEL's OPVs do not have cost overruns, and they are paying a penalty for the late delivery.

You should read my previous post.

the order was placed in 2010, the ships were to be delivered by 2014, who asked Pipavav to design a new smaller ship? GSL is one of the worst PSU shipyards and ever it delivered the saryu class OPV for the Srilankan navy within three years, an 1850 ton disp ship, laid in may 2015, delivered in March 3018.

So even with the all the ills of public sector unions and all other crap GSL delivers a ship laid in 2015 in 2018, where is the ADAG OPV again? 2019 now?